A practical guide to working with internal data to build an evidence-based understanding of your customer experience

Many organizations already sit on a wealth of information – but they fail to use it properly when starting a CX mapping initiative. Instead of reaching for external surveys or reinventing the wheel, it’s often smarter to start by looking inward and analyzing what’s already there.

Many organizations already sit on a wealth of information – but they fail to use it properly when starting a CX mapping initiative. Instead of reaching for external surveys or reinventing the wheel, it’s often smarter to start by looking inward and analyzing what’s already there.

The evaluation of existing information sources is a highly efficient and often underestimated first step in customer experience research. Done right, it lays the groundwork for a more focused investigation and a more accurate experience map.

Why begin with internal sources?

Using existing sources of information offers several advantages:

- It’s faster and more cost-effective than launching a full-scale study from scratch

- It helps you detect early patterns and recurring issues

- It gives you an evidence base for framing questions in interviews and workshops

- It allows for a bottom-up view of the experience, based on actual observations rather than assumptions

This early phase of research isn’t about creating final answers — it’s about scouting the terrain before deeper investigation.

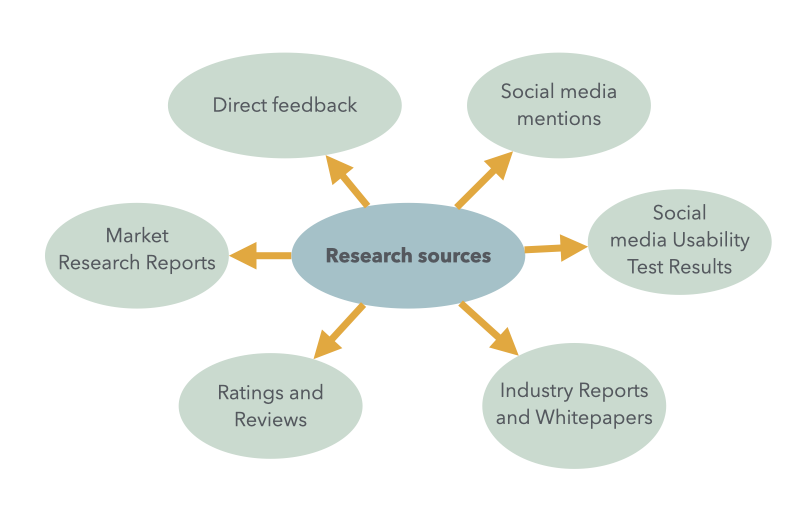

What types of sources should you review?

Here are the most common (and most overlooked) categories of useful material:

Direct Feedback: Collect recent emails, contact form submissions, or call center transcripts. These frontline interactions reveal actual concerns, questions, and frustrations.

Social Media Mentions: Look into what people are saying about your brand on platforms like X/Twitter, LinkedIn, Facebook, or Reddit. Include positive and negative mentions alike — both offer valuable insight.

Ratings and Reviews: Review platforms relevant to your product or service category. Whether it’s e-commerce, hospitality, software, healthcare, or education — most sectors have dedicated spaces where customers leave public feedback. These reviews are often rich in real-world context, highlight emotional responses, and reveal what truly matters to users.

Market Research Reports: If your organization has already conducted surveys, focus groups, or customer segment analyses, use the findings. These often provide structured insights into needs, preferences, and perception.

Usability Test Results: Review recordings, notes, or outcome reports from earlier usability testing. These give clues about navigation issues, content gaps, and unclear terminology.

Industry Reports and Whitepapers: Analyst reports, studies, and whitepapers can offer external benchmarks or highlight trends in your sector. While general, they often include telling data points that can help validate patterns.

How to work with multiple sources: Structure and Synthesis

You won’t find a full picture of the customer experience in any single source. Instead, you’ll need to work across fragmented data to extract what’s relevant.

This is a bottom-up process — it takes patience and a willingness to sort through irrelevant information. Use a standardized format to document your findings and bring structure to the chaos.

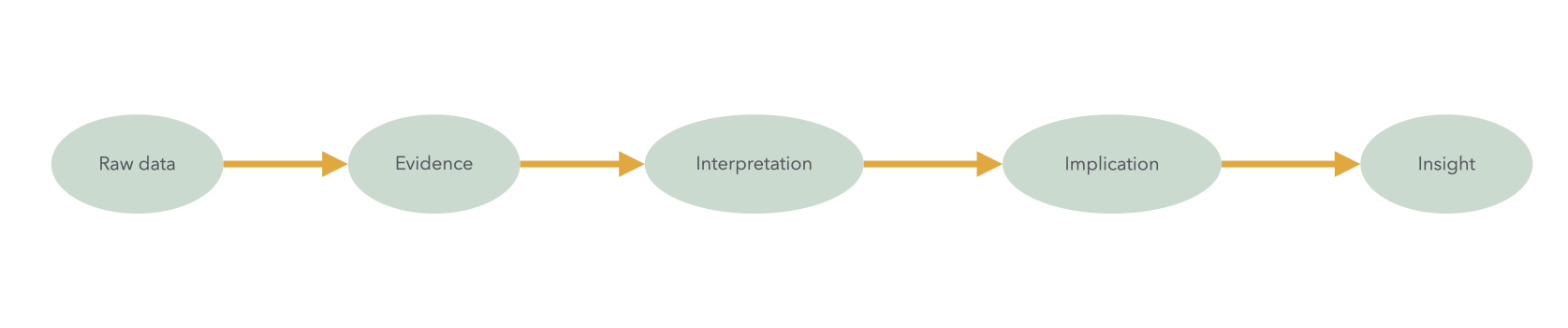

We recommend breaking down your analysis into three core components:

Evidence: Document objective facts from the source. Don’t interpret them yet. Include quotes or data points where possible. This forms the raw input.

Interpretation: Consider what these findings might mean. Why might a customer feel or behave this way? What patterns or root causes could explain it? Create multiple hypothesis.

Implications: Determine how each finding impacts the customer experience. Think beyond functionality and consider emotional drivers — frustration, relief, trust, or confusion. What does this mean for the customer’s journey? Where might expectations be unmet or moments of delight overlooked?

Each source you review should be summarized in its own structured table. This consolidation format not only helps you organize insights but also makes it easier to compare findings across different sources and detect patterns.

| Evidence | Interpretation | Implication |

|---|---|---|

| Support ticket: "I couldn’t install the app without admin rights." | Users without admin access experience a critical blocker during installation. | Installation process needs redesign or alternative path. |

| App Store review: "Great service, but confusing to navigate." | Users have trouble locating key features despite liking the service. | Improve IA/usability to reduce onboarding friction. |

| Survey result: 67% learned about us from friends or colleagues. | Word-of-mouth is the primary acquisition channel. | Invest in referral programs and social proof. |

From fragments to focus: How to draw meaningful conclusions

Once you’ve gathered and structured the implications, bring them together in a master list. Group them by topic, theme, or journey phase. This list becomes your evidence-informed hypothesis set — the issues worth exploring further.

Here are sample conclusions you might extract from consolidated CX evidence:

- Installation is a major friction point in the user journey

- Users without admin rights experience installation as a dead-end (a critical blocker)

- Customer support is perceived as highly responsive and helpful

- Word-of-mouth is the dominant acquisition driver

- Customers use the service across multiple devices, which introduces inconsistencies

Some findings — like the impact of word-of-mouth — may be obvious and require no further research. Others, such as frustration during installation, signal deeper problems that need to be investigated through interviews, usability tests, or contextual inquiry.

Evidence-based thinking strengthens every step that follows

Reviewing existing sources is more than a preparatory exercise. It’s a foundational move that helps you:

- Spot key themes and knowledge gaps

- Define your research priorities

- Prepare more informed stakeholder interviews

- Accelerate map creation by filling in obvious sections with validated input

Importantly, this process gives you a more grounded sense of what’s actually happening — before anyone sketches a journey map.

The goal isn’t to find all the answers, but to ask much better questions.

How much time should this take?

You don’t need weeks. Depending on the number of sources, a small team can complete this process in a day or two. If possible, divide sources among team members and use a shared format to consolidate insights. Afterward, review findings together and agree on key takeaways.

Conclusion: Insight is often already in your hands

Before spending budget on new research, start by asking:

What do we already know – and what are we hearing, but not acting on?

A focused scan of existing material can surface the most pressing customer truths — and help your mapping project build on facts, not fiction.

Your next journey map will be stronger, clearer, and more actionable — simply because it starts with real evidence.