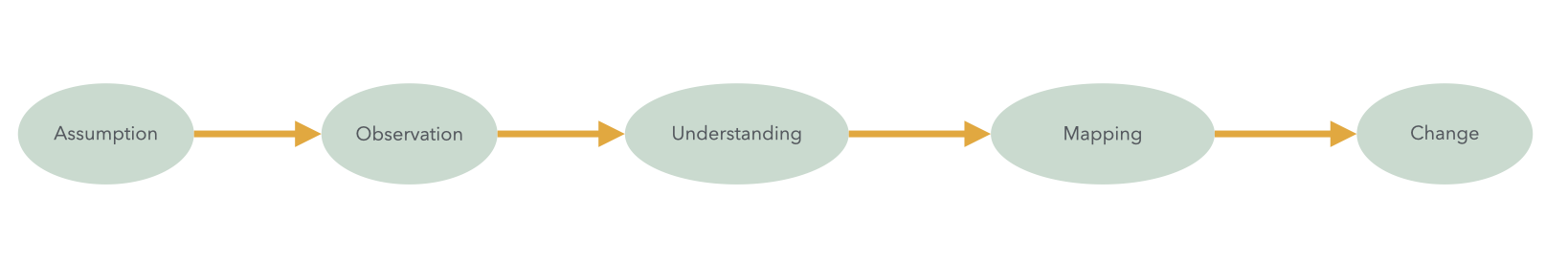

Solid Customer Experience Mapping doesn’t start with visualization — it starts with understanding.

Many CX mapping projects begin with a workshop, a few Post-its, and a blank board. The team notes internal assumptions about customer needs and sketches a journey that’s mostly based on guesswork. The problem? Without solid research, every map remains a wishful internal narrative.

To truly understand customer experience, you need more than process knowledge or product logic. You need real insight into the experiences, behaviors, and thought processes of the people you’re designing for.

Mapping is analysis, not decoration

A journey map isn’t a decorative poster — it’s an analytical tool. It’s not about representing something; it’s about understanding something. And that “something” is often invisible in everyday business life: the subjective reality of customers.

“You can’t improve what you don’t understand.”

Many companies have access to detailed demographic data, extensive purchase stats, and usage metrics — and yet they know little about the real needs and motivations of their target audiences. Part of the problem is that human behavior is rarely rational. Decisions are made emotionally, in context, and often inconsistently. These things can’t be fully captured through numbers alone.

Good Customer Experience is built not on data depth, but on understanding.

Combine internal and external perspectives

A sound research process brings together two perspectives:

- Internal view: Interviews with employees, process analyses, support data evaluation. These reveal how the company thinks, operates, and is organized.

- External view: Conversations with customers, contextual observations, field studies. These show how people actually experience the offering.

Both perspectives are essential — but in practice, the external view is often neglected. Companies spend large sums on market research but avoid direct contact with their users. And yet, that’s where the most valuable insights lie — often surprising, sometimes uncomfortable, but always illuminating.

Why research is the key

Research is not an end in itself — it delivers:

Trust in the map: It’s based not on creative speculation but on validated insight.

Clarity about what matters: It reveals where the real problems lie — not just the perceived ones.

Direction for decisions: It gives leadership and teams a solid basis for making choices.

Empathy for customers: It encourages perspective shifts and challenges internal assumptions.

“The customer rarely buys what the company thinks it is selling.”

– Peter Drucker

What methods are useful in the mapping process?

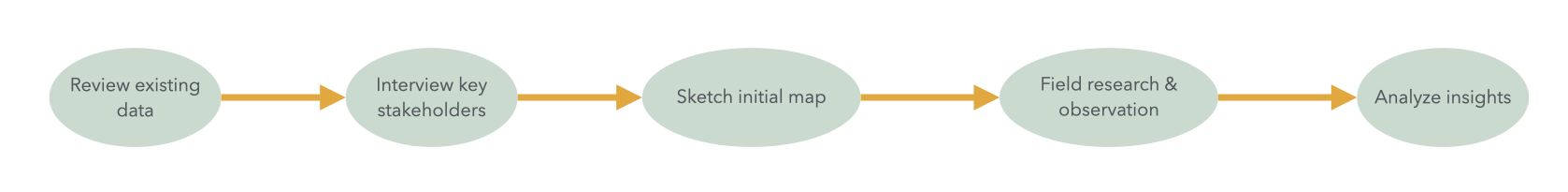

There are five essential research steps that can be used flexibly and iteratively:

| Label | Description |

|---|---|

| Review existing data | Analyze CRM data, support tickets, customer feedback, internal reports |

| Interview stakeholders | Conduct interviews to gather and structure internal knowledge |

| Sketch initial map | Create a first visual draft of hypotheses and assumptions about the journey |

| Field research & observation | Observe users in their real context (e.g., through contextual interviews) |

| Analyze insights | Structure and interpret qualitative data, identify patterns and clusters |

1. Review existing data sources: Support tickets, customer feedback, social media, sales notes — these provide early access to patterns, pain points, and the language your audience actually uses.

2. Interview internal stakeholders: Conversations with employees in service, product, sales, or logistics help consolidate existing knowledge. The goal isn’t confirmation — it’s exploration. Ask: What do we think we know, and why?

3. Sketch an initial map: Start with a rough visual outline of assumptions and observations. It won’t be perfect — but it helps structure thinking and align the team.

4. Field research (contextual interviews & observations): Accompany users in context — in the office, in stores, at home. What you’ll collect is qualitative data that enables deeper understanding, not just broader measurement.

“It’s always surprising how little many companies know about the people they serve.”

The reasons are many: abstract data, no vocabulary for subjective experience, or simply lack of curiosity. Instead, companies commission expensive reports — when often, a few real conversations would do more.

5. Analyze insights: Unstructured observations must be synthesized: What was said? What does it mean? What hypotheses emerge for the next iteration of the map?

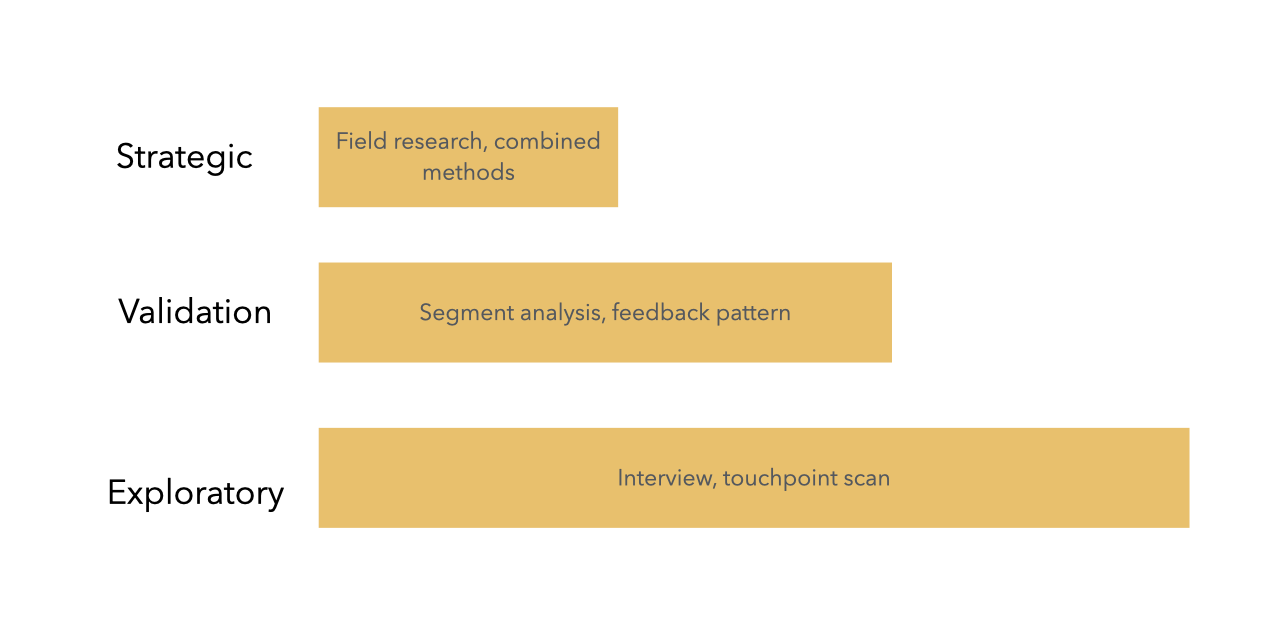

How much research is enough?

For exploratory projects:

3–5 user interviews, a half-day internal workshop, touchpoint scan — often enough for first hypotheses.For strategic projects:

Segment-specific analysis, ethnographic studies, and mixed-method research. The goal: contextual, behavior-based understanding.

Research doesn’t mean knowing everything. It means knowing enough to ask the right questions.

Conclusion: Understand before you assume

Customer Experience Mapping only adds value when it’s grounded in lived reality. Teams that take the time to observe, listen, and analyze build maps with substance — and lay the groundwork for real improvement.

Understand first. Then design. Anything else is decoration.